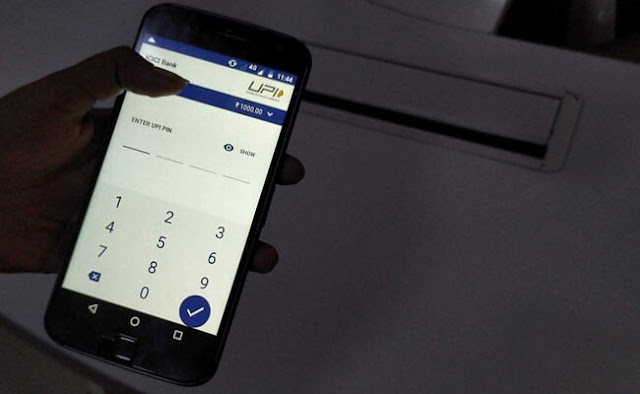

UPI Transactions Over ₹ 2,000 To Attract 1.1% Fee, But Customer Won't Pay

The National Payments Corporation of India (NPCI) has notified that an interchange price of as much as 1.1 consistent with cent can be relevant on service provider UPI (Unified Payments Interface) transactions from April 1.

In a latest circular, the NPCI stated that the usage of Prepaid Payment Instruments (PPIs) for transactions via UPI will entice an interchange price. The costs can be levied if the transaction is greater than ₹ 2,000. The interchange price varies for the extraordinary classes of merchants. It tiers from 0.5% to 1.1% and a cap is likewise relevant in sure classes.

In a notification issued today, NPCI stated that the delivered price is simplest relevant for service provider transactions made via pay as you go charge instruments. The bills frame clarified that no costs can be levied on ordinary UPI bills which it termed as "financial institution account- to-financial institution account primarily based totally UPI bills."

For telecom, education, and utilities/submit office, the interchange price is 0.7% whilst for supermarkets the price is 0.9% of the transaction value. 1% costs can be levied for insurance, government, mutual funds, and railways, 0.5% for fuel, and 0.7 for agriculture, said CNBC TV-18. The costs can be relevant from April 1.

Interchange will now no longer be carried out withinside the case of peer-to-peer (P2P) and peer-to-peer-service provider (P2PM) transactions. PPP issuers can be required to pay 15 foundation points (bps) to the remitter financial institution as a wallet-loading rate for transactions of over ₹ 2,000. The pricing can be reviewed via way of means of the NPCI on or earlier than September 30, 2023.

In August final year, the Finance Ministry said that UPI is a virtual public appropriate and that it changed into now no longer thinking about levying any costs on transactions made via it. “UPI is a virtual public appropriate with great comfort for the public & productiveness profits for the economy. There isn't anyt any attention in Govt to levy any costs for UPI services. The issues of the carrier vendors for value restoration ought to be met via different means,” the ministry tweeted.

The assertion had come after the RBI issued a dialogue paper that stated that UPI as a fund switch machine is like IMPS (Immediate Payment Service) and consequently it can be argued that costs in UPI can be much like the ones levied on IMPS fund transfers.

Post a Comment